Oregon New Vehicle Sales Tax . 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. If you’re an oregon resident and make a car purchase in another state:. Go to www.oregon.gov/dor, click on revenue online. oregon does not charge sales tax on new vehicles purchased in the state. Under “register” click on “vehicle and. The vehicle use tax applies to vehicles. In the top menu bar. what is the sales tax on cars purchased in oregon? Applies to taxable vehicles purchased from dealers outside of oregon that are. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. not all vehicles are taxable. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. The state sales tax for vehicle purchases in oregon is 0%.

from oregontaxnews.com

1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. The vehicle use tax applies to vehicles. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. If you’re an oregon resident and make a car purchase in another state:. what is the sales tax on cars purchased in oregon? The state sales tax for vehicle purchases in oregon is 0%. Go to www.oregon.gov/dor, click on revenue online. Applies to taxable vehicles purchased from dealers outside of oregon that are. In the top menu bar. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from.

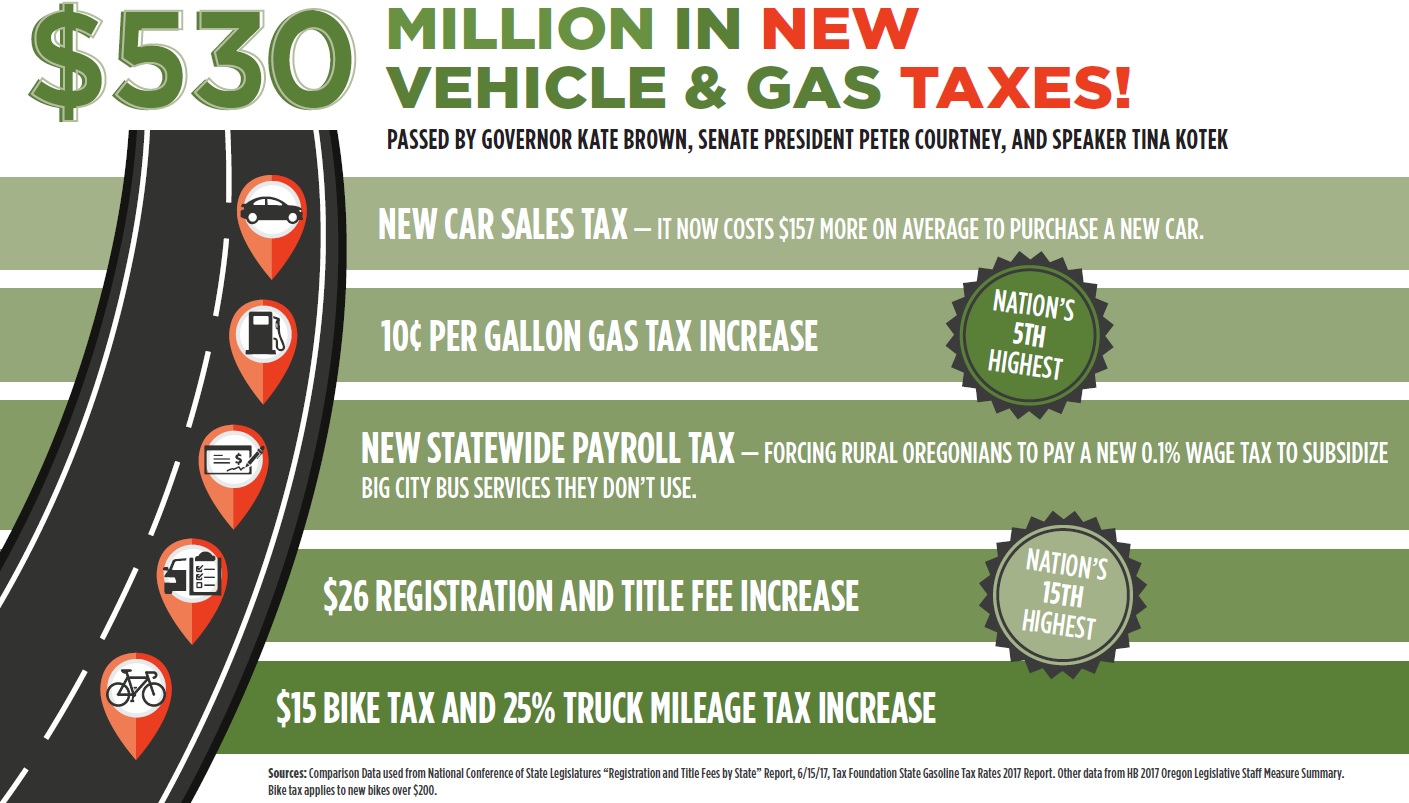

530 million in new transportation taxes Oregon Tax News

Oregon New Vehicle Sales Tax 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. Applies to taxable vehicles purchased from dealers outside of oregon that are. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. Go to www.oregon.gov/dor, click on revenue online. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. The vehicle use tax applies to vehicles. what is the sales tax on cars purchased in oregon? If you’re an oregon resident and make a car purchase in another state:. Under “register” click on “vehicle and. not all vehicles are taxable. In the top menu bar. The state sales tax for vehicle purchases in oregon is 0%. oregon does not charge sales tax on new vehicles purchased in the state.

From hxegkltbh.blob.core.windows.net

Vehicle Sales Tax Tennessee at Richard Vazquez blog Oregon New Vehicle Sales Tax The state sales tax for vehicle purchases in oregon is 0%. oregon does not charge sales tax on new vehicles purchased in the state. The vehicle use tax applies to vehicles. what is the sales tax on cars purchased in oregon? If you’re an oregon resident and make a car purchase in another state:. (1) a use. Oregon New Vehicle Sales Tax.

From www.datapandas.org

Car Sales Tax By State 2024 Oregon New Vehicle Sales Tax Applies to taxable vehicles purchased from dealers outside of oregon that are. The vehicle use tax applies to vehicles. what is the sales tax on cars purchased in oregon? The state sales tax for vehicle purchases in oregon is 0%. Under “register” click on “vehicle and. In the top menu bar. If you’re an oregon resident and make a. Oregon New Vehicle Sales Tax.

From gioejvxbc.blob.core.windows.net

Is There A Car Sales Tax In Oregon at Michael Lott blog Oregon New Vehicle Sales Tax Go to www.oregon.gov/dor, click on revenue online. The state sales tax for vehicle purchases in oregon is 0%. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. 1,. Oregon New Vehicle Sales Tax.

From legaltemplates.net

Oregon Motorcycle Bill of Sale Form Legal Templates Oregon New Vehicle Sales Tax Go to www.oregon.gov/dor, click on revenue online. Under “register” click on “vehicle and. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. In the top menu bar. not all vehicles are taxable. If you’re an oregon resident and make a car purchase in. Oregon New Vehicle Sales Tax.

From exotpwkbz.blob.core.windows.net

Lowest Car Sales Tax In Us at Caroline Doe blog Oregon New Vehicle Sales Tax The vehicle use tax applies to vehicles. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. not all vehicles are taxable. In the top menu bar. oregon does not charge sales tax on new vehicles purchased in the state. what is the sales tax on cars purchased in oregon? Go. Oregon New Vehicle Sales Tax.

From www.pandadoc.com

Oregon Bills of Sale Templates, Forms, Facts & Requirements for Oregon New Vehicle Sales Tax Under “register” click on “vehicle and. The state sales tax for vehicle purchases in oregon is 0%. oregon does not charge sales tax on new vehicles purchased in the state. In the top menu bar. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. not all. Oregon New Vehicle Sales Tax.

From oregoncatalyst.com

No to Newport gas tax hike 21206 The Oregon Catalyst Oregon New Vehicle Sales Tax 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. Applies to taxable vehicles purchased from dealers outside of oregon that are. not all vehicles are taxable. If you’re an oregon resident and make a car purchase in another state:. what is the sales tax on cars. Oregon New Vehicle Sales Tax.

From oregoncapitalchronicle.com

Oregon taxes favor wealthy but less so than most other states • Oregon Oregon New Vehicle Sales Tax Applies to taxable vehicles purchased from dealers outside of oregon that are. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. not all vehicles are taxable. If you’re an oregon resident and make a car purchase in another state:. The state sales tax for vehicle purchases in. Oregon New Vehicle Sales Tax.

From www.beavertongmc.com

New 2025 GMC Sierra 3500 HD Vehicles for Sale in Portland Buick GMC Oregon New Vehicle Sales Tax Under “register” click on “vehicle and. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. The vehicle use tax applies to vehicles. oregon does not charge sales tax on new vehicles purchased in the state. If you’re an oregon resident and make a car purchase in another state:. (1) a use. Oregon New Vehicle Sales Tax.

From gioejvxbc.blob.core.windows.net

Is There A Car Sales Tax In Oregon at Michael Lott blog Oregon New Vehicle Sales Tax not all vehicles are taxable. If you’re an oregon resident and make a car purchase in another state:. Applies to taxable vehicles purchased from dealers outside of oregon that are. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. Go to www.oregon.gov/dor, click on revenue online. The state sales tax for vehicle. Oregon New Vehicle Sales Tax.

From itrfoundation.org

Iowa’s Local Option Sales Tax A Primer ITR Foundation Oregon New Vehicle Sales Tax If you’re an oregon resident and make a car purchase in another state:. not all vehicles are taxable. oregon does not charge sales tax on new vehicles purchased in the state. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. Go to www.oregon.gov/dor, click on revenue. Oregon New Vehicle Sales Tax.

From oregonecon.blogspot.com

The Oregon Economics Blog Oregon Ranked 13th Best in Business Tax Climate Oregon New Vehicle Sales Tax Under “register” click on “vehicle and. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. If you’re an oregon resident and make a car purchase in another state:. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were. (1) a use. Oregon New Vehicle Sales Tax.

From legaltemplates.net

Free Oregon Motor Vehicle Bill of Sale Form Legal Templates Oregon New Vehicle Sales Tax (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. not all vehicles are taxable. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. what is the sales tax on cars purchased in oregon? In the. Oregon New Vehicle Sales Tax.

From money.com

Map States With No Sales Tax and the Highest, Lowest Rates Money Oregon New Vehicle Sales Tax If you’re an oregon resident and make a car purchase in another state:. Under “register” click on “vehicle and. what is the sales tax on cars purchased in oregon? Applies to taxable vehicles purchased from dealers outside of oregon that are. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. The state. Oregon New Vehicle Sales Tax.

From www.beavertongmc.com

New 2025 GMC Sierra 3500 HD Vehicles for Sale in Portland Buick GMC Oregon New Vehicle Sales Tax (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. In the top menu bar. Applies to taxable vehicles purchased from dealers outside of oregon that are. not all vehicles are taxable. Go to www.oregon.gov/dor, click on revenue online. the vehicle privilege tax. Oregon New Vehicle Sales Tax.

From itep.org

Oregon Who Pays? 7th Edition ITEP Oregon New Vehicle Sales Tax what is the sales tax on cars purchased in oregon? In the top menu bar. Applies to taxable vehicles purchased from dealers outside of oregon that are. not all vehicles are taxable. Under “register” click on “vehicle and. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor. Oregon New Vehicle Sales Tax.

From readerdom99.blogspot.com

Sales Taxes In The United States Oregon State Tax Payments Oregon New Vehicle Sales Tax If you’re an oregon resident and make a car purchase in another state:. Applies to taxable vehicles purchased from dealers outside of oregon that are. Go to www.oregon.gov/dor, click on revenue online. (1) a use tax is imposed on the storage, use or other consumption in this state of taxable motor vehicles purchased at retail from. not all. Oregon New Vehicle Sales Tax.

From motorenn.expert

Buying Tradein Sales Tax Credits Explained — Motorenn Expert Insights Oregon New Vehicle Sales Tax what is the sales tax on cars purchased in oregon? The state sales tax for vehicle purchases in oregon is 0%. In the top menu bar. not all vehicles are taxable. Go to www.oregon.gov/dor, click on revenue online. The vehicle use tax applies to vehicles. Under “register” click on “vehicle and. 1, 2018, there’s a tax on the. Oregon New Vehicle Sales Tax.